AUDUSD is a good pair. It’s behavior is somewhat predictable. This maybe due to the tight management by Royal Bank of Australia. I love to trade AUDUSD often. AUDUSD moves slowly unlike GBPUSD that can shoot up or down 200-500 pips in a day. In this post I am going to analyze a recent AUDUSD long trade. The stop loss was 5 pip and take profit target was 250 pip. This gives an excellent Reward/Risk of 50:1. I always look for trades that have a Reward/Risk ratio of at least 10:1. This ensures that you win more than you lose on average so your trading account always keeps on growing. Did you read the post on USDJPY swing trade that made 400 pips with 20 pip stop loss. Take a look at the following screenshot.

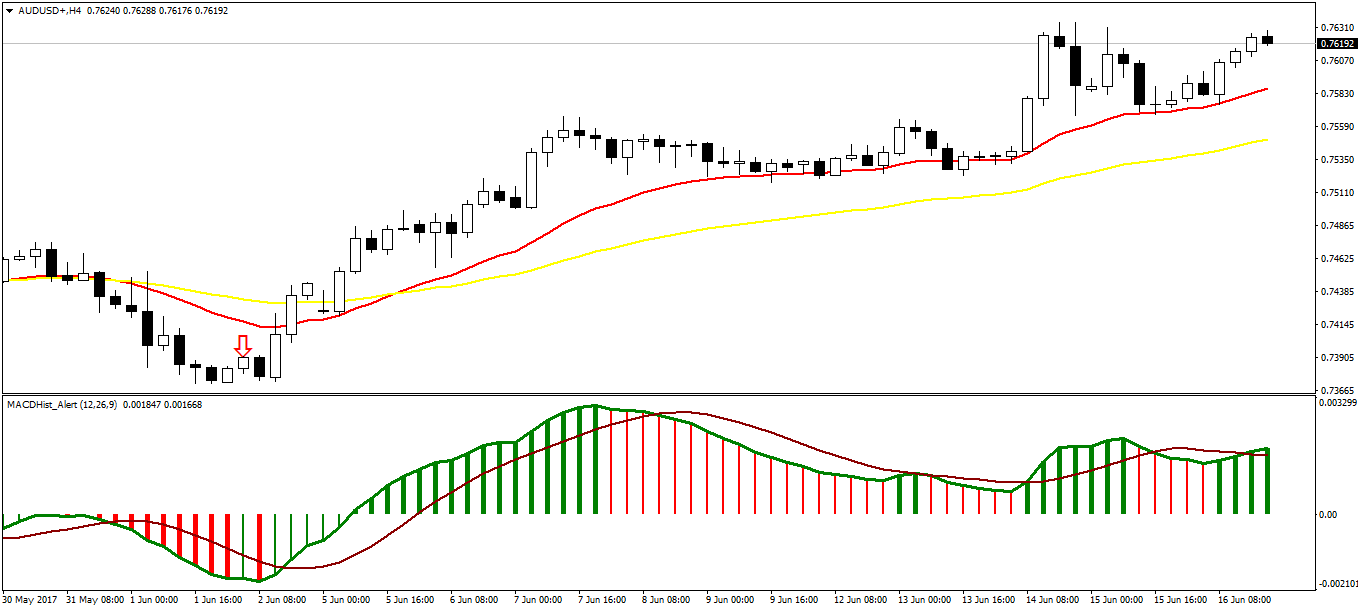

In the above screenshot, can you see the red arrow? This is the entry candle. Now analyzing candlesticks is a challenging task to tell you the truth. Correctly analyzing candlestick patterns requires good experience which many trades lack.But with practice you can acquire this experience. Candlestick patterns are very important in my trading. I use them a lot in my entry and exit decisions. To tell you the truth, conventional candlestick patterns like engulfing and the inside bar don’t work often. Don’t waste your time on mastering candlestick patterns in a conventional manner. What you need is to trade candlestick patterns in an unconventional manner. Watch this video on one candlestick pattern that changed everything for me.

In the above chart, you can see price going down then it makes a bullish candle just below the red arrow and MACD changes color. This is a signal that price has changed momentum. Price closed at 0,73905 Low made by the price was 0.73719. This is what I do. I have learned with experience that price most of the time tests the high/low in the next few bars before it changes direction. So I place a pending buy limit order with entry at 9.73750 and the stop loss at 0.73000.

Now I need to put in the take profit target. If you look at the weekly chart, you will know price has already turned.and the next resistance that it will face on the weekly chart is around 0.77700. So i comfortably put in a profit target of 0.76260. Now keep this in mind. There is no 100% guarantee that your analysis is correct. I have just looked that weekly chart. I know that price is moving up. I look up at the nearest most probably resistance level before price can turn. So I know it will be a good idea to open a buy trade. I start looking for an opportunity on H4.

Bullish candle just below the red arrow alerts me to a possible buy entry. I use a pending limit order with a very small stop loss. I know this through experience that price often tests the support/resistance before it turns back. I place a pending buy limit order with entry at 0.73750 and stop loss at 0.73700. So the stop loss is just 5 pips. But this doesn’t mean I should risk too much on this trade. I have to strictly follow my risk management rule of never risking more than 2% on a single trade. I open the trade with 4 standard lot as I have around $19K in my trading account. 1 pip is equal to $10 on a standard lot. 5 pips are equal to $50 and 4 standard lot means my total risk is $200. So my risk is 2%. Watch this interview by the #2 ranked currency trader in the world.

After 9 trading days the profit target was hit and my AUDUSD long trade was automatically closed with a profit of 250 pips. This translated into a profit of $10K. You can see one good trade can double the account. So focus on your chart analysis. Focus on the take profit and stop loss. When you think you have a good trade, you should open it. But as said above, never risk more than 2% of the account at any time. First let this AUDUSD buy trade move into profit. Once it is in profit move the stop loss to breakeven and now you can look for another trade opportunity.

Now I share a few secrets with you. I use machine learning and artificial intelligence in my trading decisions. Yes this is how I know this is the time to enter into a trade. I have a high probability of success. I use a few machine learning algorithms to analyze the daily and the weekly chart. Now machine learning and artificial intelligence is also now 100% accurate. But when I combine my candlestick patterns with machine learning and artificial intelligence I get what I want. Read this post on an introduction to R for currency traders. Algorithmic trading is the future. You should start learning it now before it is too late.

So when you are trading, be patient and disciplined. As you saw, this AUDUSD swing trade took 9 days to hit profit target. Once the trade is positive, you should move the stop loss to breakeven. This will now make your trade risk free. The worst lost that you can suffer is zero pips. Always do this in swing trading. Trend can change anytime. Things are not perfectly clear. Any breaking news can make the market jittery and nervous. It can change direction. So once you have the trade breakeven you are safe from suffering sudden reversals. Read this post that explains how GBPUSD started rallying hard when UK Elections were announced a few months back. At that time market thought this as something bullish.

Don;t be greedy. Choose your swing trades with a lot of caution and care. Focus on the quality. Quality means you are going to focus on stop loss and take profit targets. Only open a trade when you have a Reward/Risk of 10:1. This will ensure that you always win more than you lose. So your account will keep on growing. Focus on making 1000 pips per month. That’s all. If you have played tennis or golf, you know that when you are a good player things have a flow with them. You don’t have to struggle hard to make a winning shot. The same applies to trading. If you are struggling a lot in your trading, it means you need to take a deep look at your trading system before you start trading again.