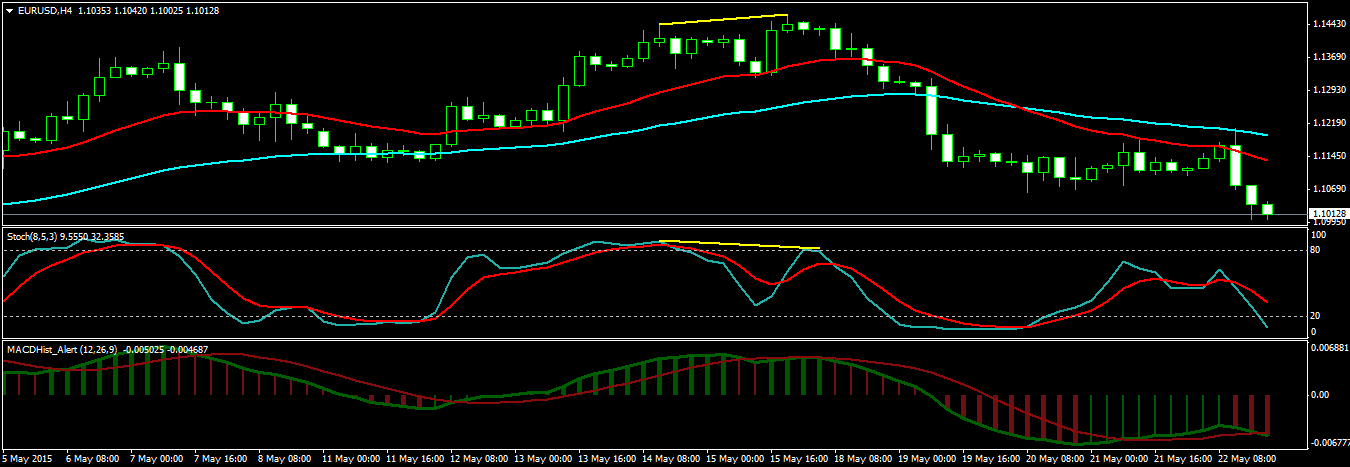

EURUSD fell more than 450 pips this week when ECB announced that it will be going heavy on QE starting this week. On Monday, a clear bearish divergence signal was appearing on H4 chart. Take a look at the following screenshot.

You can clearly see a strong bearish divergence pattern appearing in the above screenshot. On Wednesday FOMC Meeting Minutes were released. EURUSD climbed up 100 pips but then on Friday around the time of Janet Yellen speech, EURUSD started falling once again and it fell heavily in the last few remaining trading hours of Friday.

EURUSD has started falling once again and it may reach the parity level as was being predicted by the market analysts a few months back. EURO currency is in deep trouble. It has weathered many challenges but still new challenges start cropping up.

Draghi’s blunt remarks address the widening rift between countries such as Germany, which seeks to balance its spending against income, and heavily-indebted Greece, which resists economic reform.

If you are a currency trader, you should know this that 2 things drive EURUSD, EURO and USD which is of course obvious. But the devil in in the details my friend. You need to keep a constant watch on what ECB is doing and what the FED is doing. FED is under a lot of pressure to increase the interest rates. But FED Chairwoman Janet Yellen has been resisting this pressure till now. She things she needs to see more economic data before she decides to increase the rates.

But if FED increases the interest rate, EURUSD will take a strong plunge down and the prophecy about EURUSD achieving parity will be easily achieved. ECB is also going heavy on QE which means purchasing more assets from the market. Purchasing more assets is going to flood the market with cheap EUROs which is going to again plunge EURUSD down. So for now EURUSD seems to be on the downward march.