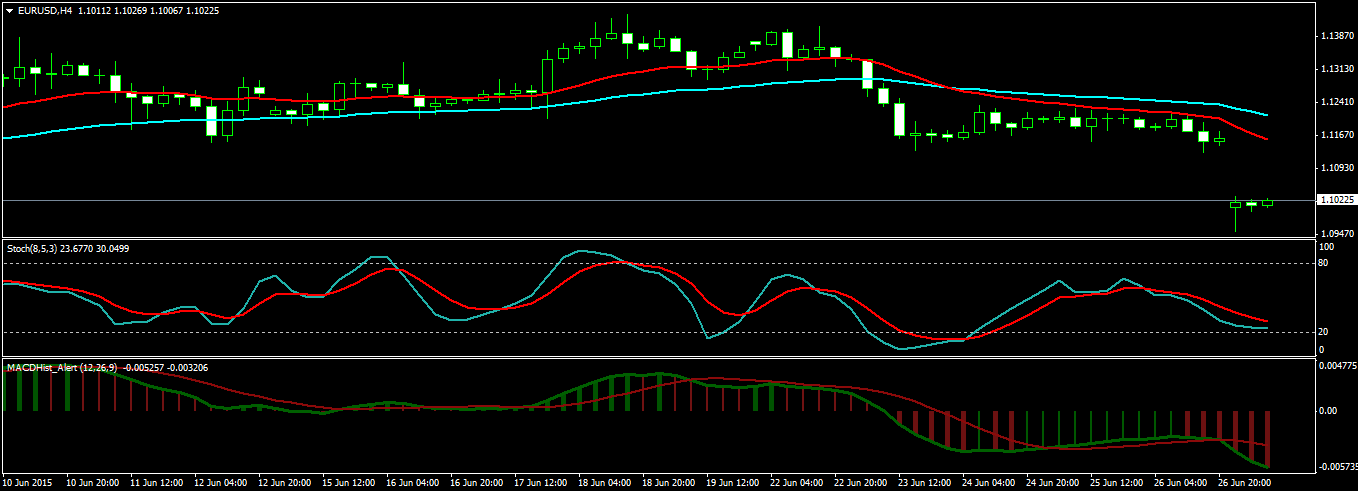

EURUSD was making a nice W pattern on H4 chart on Friday when the last time I had checked the charts. This was the time when last minute efforts were being made to avert a Greek default. But things didn’t work out. Over the weekend the Greek government instituted tight capital controls indicating a default. EURUSD opened with a huge 200 pip gap on Monday. Take a look at the screenshot below!

This is a good lesson for you. Always keep this mind whatever happens over the weekend gets reflected in the Sunday gap that you find on Monday when the market opens. If the news had been good and there had been a bailout package for Greece, you would have found EURUSD to have jumped up.

Now most probably Greece will exit the Eurozone. Will this help? Maybe. Trading these Sunday gaps can be a lucrative proposition only if you know how to trade them.