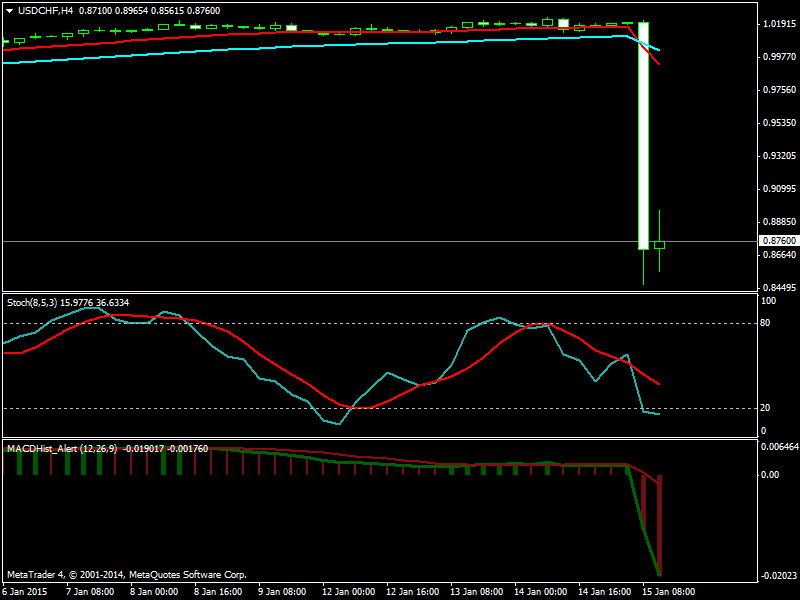

Today USDCHF fell 1867 pips in just one day when the Swiss National Bank (SNB) announced that it was scraping its minimum exchange rate policy. SNB had fixed CHF exchange rate 1.20 franc per euro and just a month ago was saying the it will defend this rate with utmost determination. As you can see in the screenshot below USDCHF fell almost 1867 pips in a short period of time.

SNB policy decision announcement made other currency pairs also gyrate a lot. EURUSD fell 150 pips on the announcement then recovered almost 100 pips within a short span of time. GBPUSD and GBPJPY also fell on the announcement. GBPUSD made a full recovery.

The Swiss central bank introduced the minimum exchange rate policy in Sept. 2011 in an attempt to halt the rise of the franc — a traditional safe-haven currency for investors — against the euro at a time when the eurozone debt crisis was at its height. The strong franc was particularly problematic for Swiss exporters, who were forced to drastically cut their prices to remain competitive.

The fall of USDCHF is a clear indication of the power Central Banks have over the currency market. Central Banks are the most important players in the currency market. Currency trader trading CHF Libor rate today would have easily nailed in these 1867 pips in just one day.

Deflation is becoming one of the major challenges for the Eurozone. With oil price crashing, deflationary pressure is going to build up in the global economy. The Swiss National Bank’s move on Thursday to abandon a cap on the Swiss franc against the euro is part of a strategy to fight deflation, Marc Chandler, Brown Harris Brothers’ global head of markets strategy, told CNBC.