Railroad tracks are appearing on the GBP/USD weekly chart. Railroad tracks is a very important trend reversal candlestick pattern. A railroad track candlestick pattern develops when one candle is bullish and the other is bearish or vice versa and both are long. Take at the look at the 0.0% Fibonacci Level and you will once again find a railroad track pattern. The first candle is bullish while the second candle is bearish meaning the trend has changed. The trend did change and price dropped by more than 900 pips. This will be a series of posts in which I start from the initial trade setup and will continue and explain each step of the GBP/USD swing trade. Right now GBP/USD is showing railroad tracks at the 100% Fibonacci level. Take a look at the following screenshot.

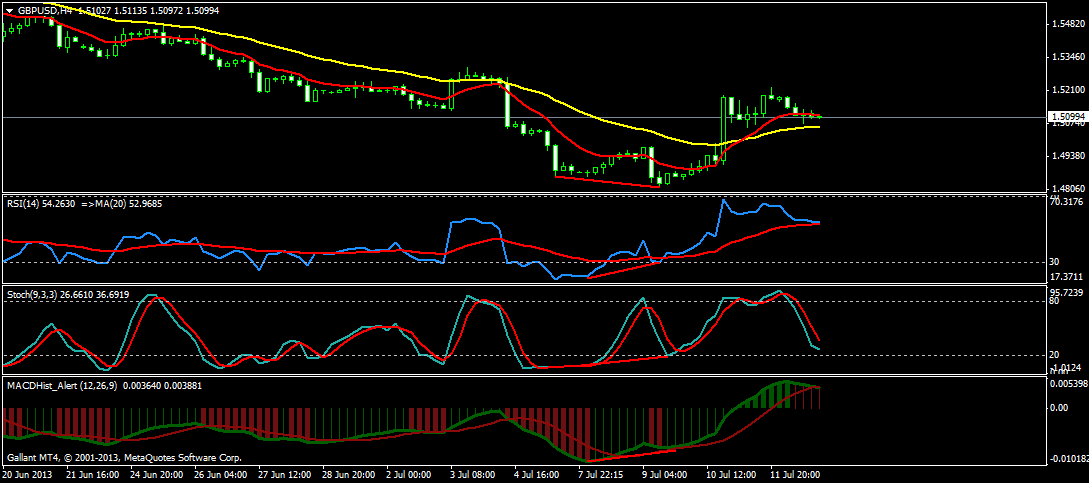

If you take a closer look at the above screenshot, you will find RSI, Stochastic and the MACD showing bullish diveregence. Bullish divergence is another strong signal that the downtrend has changed and it will be an uptrend from now on. Now take a look at the H4 timeframe. This is our main timeframe that we will be using for making the entry and exit decisions.

In this screenshot RSI, Stochastic and the MACD are showing strong bullish divergence. Market has already moved up by more than 400 pips which confirms our analysis that the trend has changed. There has been a retracement of about 140 pips. As you can see EMA10 (Red) has crossed above EMA34 (yellow) confirming that an uptrend is now in place. Stochastic is near the oversold region now. This screenshot was taken at the close of Friday. Next week, we will wait for the Stochastic to reach the oversold region below 20. When it does we will open a long GBP/USD trade. In the next series of posts I will be analyze the trade as it progresses. This trade can continue for a couple of weeks and can results in a move which is greater than 1000 pips. So stay tuned!